You can once again get a 3 month trial of Amazon Prime. This is an awesome deal. I had this once before and it was really nice... free faster shipping!

http://feedproxy.google.com/~r/SlickdealsnetFP/~3/NrtYidhdxWE/28834

Thursday, December 31, 2009

3 Months of Amazon Prime

Monday, November 16, 2009

USAA Expands Membership

USAA has further expanded their membership to include all veterans who were honorably discharged, no matter what the length of time in service. Family members of service members may be eligible as well. If you think you might be eligible I highly recommend that you check it out. You can read some good comments about USAA here. I have been more than pleased with my membership.

Thursday, October 29, 2009

ING Plans to Sell ING Direct

Wednesday, October 14, 2009

World of Goo Name Your Price

2010 Chick-fil-A Calendar Coming Soon

Friday, October 9, 2009

First-Time Homebuyer Credit Extended for Military

Sunday, September 27, 2009

Starting Salary A Critical Difference

DiscoBunny1979 wrote:

"My experience has been that it's really important to obtain the appropriate compensation from the beginning because all pay increases go from that initial salary."

This seems like an important tidbit to keep in mind if you are hunting for a job.

Saturday, September 26, 2009

Why You Still Need an IRA

Note: The views expressed on this blog are strictly my own and do not represent the opinions of the U.S. Military or any other agency.

Tuesday, September 15, 2009

Budget Tracking with Google Docs

Wednesday, September 9, 2009

50 Cent on Investing

Monday, June 15, 2009

New Credit Card Law

- Companies required to mail statements at least 21 days before the payment is due.

- The payment due date is required to stay the same each month.

- Credit Card companies will be required to show how long it will take to pay off your balance making only the minimum payment. *I think this is a great change. Too many people don't realize the impact of small payments with high interest. Too bad they don't show how much total interest you would end up paying.

- You can no longer be charged an over-the-limit fee for transactions that exceed your credit limit unless you sign an agreement saying that you specifically want to allow transactions that will exceed your limit.

- Payments in excess of the minimum amount will be required to pay off balances with the highest interest rates first.

- Companies won't be able to increase rates on the existing balances for the most part, but they will be allow to increase the rate on new purchases after the first year. A penalty rate cannot be applied unless you don't make your payments for more than 60 days, and then a 45 day notice is required before the rate change. *I disagree with this provision. I think it is the companies right to fluctuate the rate in response to the market. If you don't want to be subjected to market changes in interest rates, then you shouldn't take out unsecured credit.

- For rate changes on new purchases, 45 days notice will be required. Also, you will have the option to close your account if you disagree with the new rate.

Saturday, June 13, 2009

Thrift Savings Plan Upgrades

From the article:

put some or all of their after-tax salary into an account that will

grow without tax liability on future earnings.

The Federal Retirement Thrift Investment Board said this will encourage

more young employees to start saving for their retirement as soon as

they begin working for the government and take advantage of matching

funds offered by their agencies.

• A survivor benefit that would allow spouses of deceased TSP participants to maintain TSP accounts.

• A mutual fund option that would allow participants to direct their

TSP funds to private-sector mutual funds. The board would be authorized

to select the mutual funds that would be available to plan

participants.

I think the first three are definitely good improvements to the program. The fourth one I could care less about. It's noncongruent with the Boglehead philosophy. I'm very pleased with their current low-cost index funds. As long as they keep those, I'll still be happy. The bad thing is that people will bite off on these funds, which I think is a mistake.

The original article from the Federal Times can be found here.

Tuesday, April 28, 2009

Free Mother's Day Card

Mr. T - Treat Your Mother Right

Tuesday, April 7, 2009

iTunes Ups Their Prices

price structure in April, older tracks priced at $0.69 would outnumber

the contemporary hits that are rising to $1.29. Today, several weeks

later, iTunes made the transition. While the $1.29 tracks are

immediately visible, locating cheaper tracks is proving to be an

exercise in futility. With the exception of 48 songs that Apple has

placed on the iTunes main page, $0.69 downloads are a scarce commodity."

I stopped using iTunes a while back and have been very pleased with the decision. The DRM is an unnecessary hassle that just makes life more difficult. I used TuneClone to convert my iTunes songs from DRM'ed m4p files to mp3. It creates a virtual CD burner and allows you to 'burn' playlists to the virtual drive. It automatically converts any songs sent to the drive into mp3 and stores them in the folder you specify. As far as purchasing new songs, I've chosen to use Amazon.com

Monday, March 23, 2009

Free Game from Amazon

Tuesday, March 10, 2009

This Too Shall Pass

Source: dshort.com

Monday, March 9, 2009

Sunday, March 8, 2009

Is $6600 Really That Low?

If we look at 1980, the Dow was around $830. A common number for the average growth of the market is 8%. So if we take $830 in 1980 and grow it at 8% for 29 years, it comes out to $7,733.34. This is higher than where we're at, but not too much higher. Even at 10%, we'd be looking at $13,166.37. I think the $14,000 range that the Dow was at previously (July 2007) was outside of the norm and that at least part of the drop in value is due to a correction back from that bubble. I know that won't do much to comfort those (myself included) who have seen a drastic drop in the value of their portfolio, but maybe it will help keep you from worrying too much about a total collapse of the market.

Friday, March 6, 2009

What is the Savings Deposit Program?

- Must be in the armed forces and receiving Hostile Fire Pay

- Must be deployed 30 consecutive days or at least part of 3 consecutive months

- Deposits may not be more than your unalloted pay and allowances for the given month.

- 10% APY, compounded quarterly

- Deposits must be in multiples of $5.00

- Withdrawals may only be made when you leave the combat zone or in the event of an emergency (requires commander's approval)

- However, if you have more than $10,000.00 in the account, the amount of $10K (the part not earning interest) may be withdrawn while still deployed

- Interest will continue to accrue for up to 90 days after you leave the combat zone (so wait three months to withdraw the money! Or, redeploy within three months to keep it going.)

Reference: http://www.dfas.mil/militarypay/woundedwarriorpay/SDPBrochure_Mar08.pdf

Thursday, March 5, 2009

Oldie but Goodie

http://www.hulu.com/watch/1389/saturday-night-live-dont-buy-stuff

Monday, February 23, 2009

Industry and Frugality in 1919

Wednesday, February 18, 2009

Unfathomable Spending

P.S. - 1.062 trillion is 1 062 000 000 000

Monday, February 16, 2009

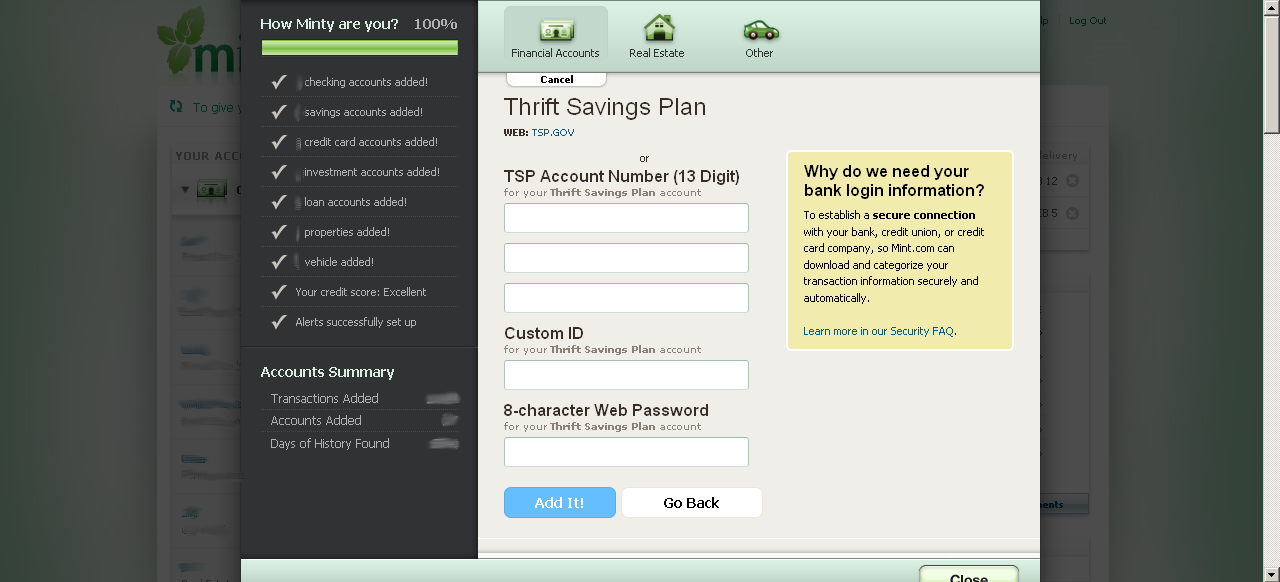

How to Add the TSP to Mint.com

After you click "Search" you should only have one option. Choose that and then you should get the next screen shown below. Make sure it says tsp.gov on there somewhere.

Now just fill in your information, you'll need your TSP account number, your ID that you created on the website, and your web password. Notice you'll need to enter the TSP account number 3 times. I recommend copying and pasting because there's no worry of putting in the wrong account number. It won't go through if the password doesn't match. If you haven't created an ID yet, you'll have to go to the website and then wait for your custom ID to become active before adding the account to mint.

After you're all done, you will see your TSP account listed under investments. Hurray!

Wednesday, February 4, 2009

More Tax Software

Senate Bumps Up Homebuyers Tax Credit

The Senate voted Wednesday night to give a tax break of up to $15,000

to homebuyers in hopes of revitalizing the housing industry, a victory

for Republicans eager to leave their mark on a mammoth economic

stimulus bill at the heart of President Barack Obama's recovery plan.

The tax break was adopted without dissent, and came on a day in which

Obama pushed back pointedly against Republican critics of the

legislation even as he reached across party lines to consider scaling

back spending.

Look for more information in the coming week. The original article can be found here.

Tuesday, February 3, 2009

Evil Landlords, Archaeologists, Scuba Divers, and Scruffs?

http://slickdeals.net/permadeal/17933

Saturday, January 17, 2009

Monday, January 12, 2009

P2P Lending Debacle

Saturday, January 10, 2009

Chop Your Mortgage

For this example, I'll be using DecisionAide.com's Mortgage Prepayment Calculator. Let's say you have $100,000.00 remaining on your loan. You've owned this place for 1.5 years and so you've got 28.5 years left on the mortgage. Your interest rate is 6.5% and you make payments every month.

1. Enter 100000 as the loan amount in the first box

2. Enter 6.5 as the interest rate in the second box

3. Now, you need to figure out how many months are remaining on your mortgage. 28.5 years * 12 mos./year = 342 months. So, enter 342 for the third box.

4. Most likely you make payments every month. So, enter 12 for the fourth box.

5. Now, if you'd like to know what adding $200 / month will do for you, setup the first line of extra payments like this: Monthly | 200.00 | 1 | Until End of Loan | [leave this blank]

Now click "Display Extra Pmt Benefits." You will see that an extra $200 /mo. will result in a savings of $59,379.04 and shorten the length of the loan by 151 months (12 years and 7 months)!!

Thursday, January 8, 2009

$7500 Federal Housing Tax Credit

For aspiring home owners who find their goal stubbornly elusive, newly enacted legislation providing a tax credit of as much as $7,500 for first-time home buyers might just be the opportunity of a lifetime.

But like so many of the good things in life, time is of the essence for buyers who want to take advantage of this outstanding opportunity. Only homes purchased on or after April 9, 2008 and before July 1, 2009 are eligible. Use the links below to learn more about the tax credit.

If this offer sounds too good to be true, it's because it is. Reading the website you might not realize what the catch is. Although the government is giving $7500 to qualified new home-owners (income of < $75,000 and have not owned a home in the past 3 years for single individuals) you are required to pay that money back over 15 years or whenever you sell the house. You make no payments for the first 2 years and if you sell the house at a loss, the debt is forgiven.

On the whole, I would not recommend this unless it's absolutely necessary. I don't think it's a good reason to buy a house you wouldn't otherwise buy or be able to afford, and I'm always against taking on unnecessary debt. However, if you think you are disciplined enough to invest it instead of blowing it on something and you can afford your new home with or without the tax credit, then go ahead.

2009 Action Plan for Free!!

As someone once told me, "if it's fo' free, it's fo' me!" Until January 15th Suze Orman is offering up her book, Suze Orman's 2009 Action Plan, for free!

Sunday, January 4, 2009

Jack Bogle Wishes Bogleheads a New Year

Jack Bogle, founder and former CEO of Vanguard, visited the Bogleheads forum to wish everyone a new year. If you haven't read it yet, I highly recommend grabbing a copy of The Bogleheads' Guide to Investing and finding out what it means to be a Boglehead!